PDO vows renewable focus despite GlassPoint liquidation move

OIL AND GAS NEWS

Petroleum Development Oman (PDO), the sultanate’s leading oil and gas producer, has vowed to continue with its ambitious renewable energy objectives, notwithstanding the announcement by key technology partner GlassPoint Solar to go into liquidation, a report said.

A PDO statement acknowledged that the US-based technology startup – billed as a pioneer in the use of solar energy for steam generation in heavy oil production – was facing liquidation following the Covid-19 crisis, an

Oman Daily Observer report said.

Oman owns 31% of shares in GlassPoint Solar. Royal Dutch Shell is also a key stakeholder.

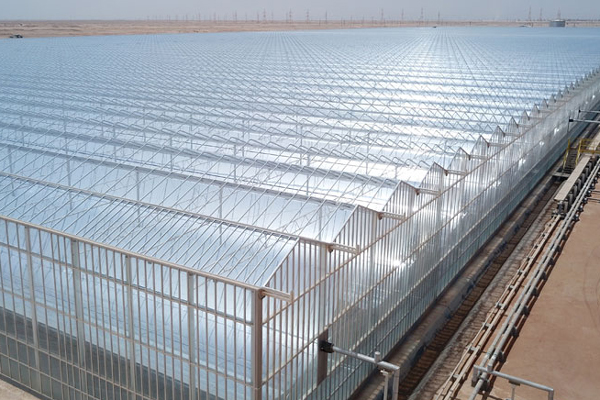

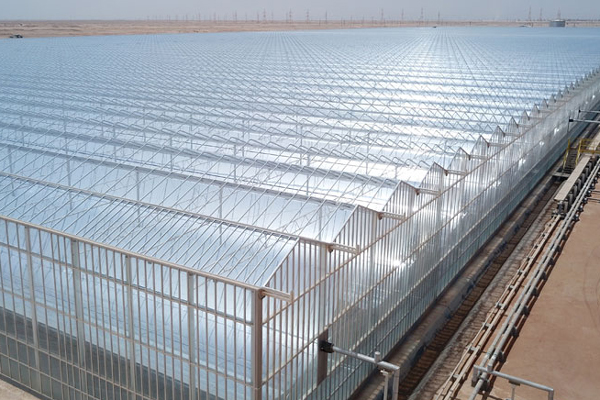

California-headquartered GlassPoint Solar is a technology partner in the development of PDO’s Miraah project — a giant 1,021 MW solar farm currently in an advanced stage of implementation at the Amal field in the south of the Sultanate.

Construction on the project began in October 2015 with part of the vast scheme already in operation. At full capacity, it will feature a total of 36 glasshouse modules, covering an area of more than 360 football pitches, said the report.

“PDO is proud of the flagship Miraah project delivered using GlassPoint technology in our Amal solar steam operations. PDO is fully equipped to operate the solar facilities to its full potential and remains firmly committed to renewable energy and its ongoing transition to a fully-fledged energy company,” it noted.

The State General Reserve Fund (SGRF), the largest sovereign wealth fund in Oman, is a key shareholder in GlassPoint Solar. So is Royal Dutch Shell.

In recent years, the Sultanate had emerged as a key focal point for GlassPoint Solar’s Middle East operations. In addition to its important partnership with PDO, GlassPoint Solar had also signed a Memorandum of Understanding (MoU) with Occidental Oman in November 2018 for the development of a world-scale solar thermal energy, exceeding 2 gigawatts in capacity, at the Mukhaizna heavy oil field in the Sultanate.

After a special board meeting last month, the CEO of Glasspoint Solar wrote to employees that a decision has been taken to immediately place GlassPoint in a voluntary liquidation process.

This followed Mitsui informing the board that due to the very difficult economic circumstances and uncertainty around the global Covid-19 pandemic, it cannot make the necessary and planned investment in GlassPoint at this time.

A Shell spokesperson has been quoted as saying that GlassPoint has not been able to secure the funding needed to allow the company to continue as planned.